The elephant in the room

The new vehicle market includes a growing variety of alternatives to the conventional internal combustion engine, but consumers remain hesitant to switch. What’s holding them back?

President of DesRosiers Automotive Consultants Inc., Dennis DesRosiers is Canada’s leading automotive industry analyst and one of the foremost theorists in the North American automotive industry.

If you believe various government reports, millions of Canadians will be driving a battery electric vehicle (BEV) by 2030, and if you believe predictions from the Ontario government “at least 80 percent of people should be using electrified public transit, walk or cycle to work” by 2050. Conspicuous by its absence is any mention of using a passenger car or light truck powered by an internal combustion engine (ICE).

Ontario has now set an electric and hydrogen passenger vehicle sales target of five percent by 2020. Quebec is implementing a zero emission vehicle (ZEV) mandate, and other provinces—British Columbia and Alberta in particular—are encouraging consumers to move away from their current gasoline powered vehicles and instead embrace alternate powertrain vehicles. And in the midst of all these government expectations and mandates, Tesla has launched its new Model 3 and booked orders for more than 400,000 units internationally for a vehicle that won’t even be on the road for a few years. We do not know how many were pre-sold in Canada.

These are high-level aspirations that have a fundamental problem: to date Canadians have pretty well rejected BEVs; indeed hybrid vehicles also appear to be in trouble from a market perspective. This is the ‘elephant in the room’: our politicians and regulators are forecasting huge sales growth for vehicles that few Canadians want to buy. BEVs have been available for sale in Canada for five years and, over that time, Canadians have purchased fewer than 10,000 units. Hybrid vehicles have been available in Canada for sixteen years and over that time Canadians have purchased fewer than 200,000 units. What’s more, sales have declined for three years in a row. There are 25 million light vehicles on the road in Canada so these advanced powertrain vehicles account for a miniscule percentage of units in operation.

Disappointing sales performance

There are many reasons for the lack of sales of both BEVs and hybrid vehicles, including higher capital costs, very poor resale values, lack of availability in a full range of shapes and sizes, dealers’ reluctance to sell them, higher repair costs, the lack of a charging infrastructure and the time it takes to charge a vehicle. And the biggest issue for BEVs is still battery technology, which is at the root of ‘range’ anxiety. A few hundred kilometres is the typical range in ideal conditions and this limits BEV use and scares a lot of consumers away from buying them. Advances in battery technology and a charging infrastructure will help but have had little impact so far.

I believe most of these reasons are important but miss the most important factor: vehicle companies are making huge strides improving the fuel efficiency of their current ICE vehicles and meeting consumer and regulatory demand in the process.

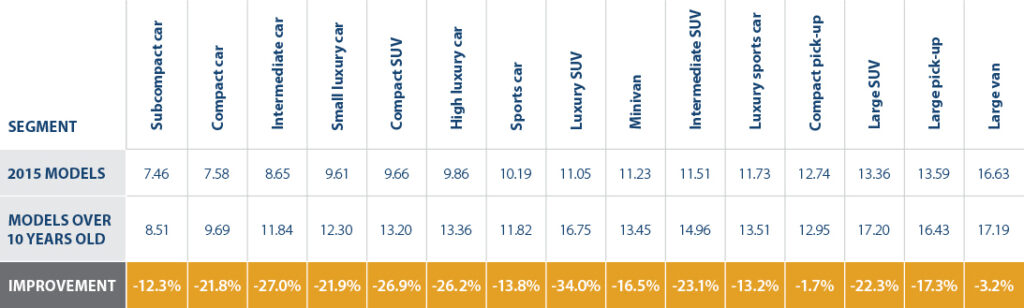

If you examine the actual fuel efficiency of the 15 vehicle segments currently in the market in Canada, you will see that almost all segments have improved by more than 20 percent over the last decade (see page 14). So if a consumer is seeking better fuel efficiency all they have to do is buy a new vehicle. They don’t have to compromise on the size of their vehicle or the power of their vehicle or worry about battery range. They simply have to go into their local dealer and buy a new ICE vehicle. And that is exactly what 99-plus percent of consumers in Canada are doing.

Balancing energy-consumption factors

Regardless of vehicle type or the size or type of powertrain, the three biggest determinants of energy use in a vehicle are:

- Driver behaviour – including driving habits and maintenance practices

- Vehicle weight – the dominant factor at low speeds in the city

- Vehicle aerodynamics – the dominant factor at highway speeds

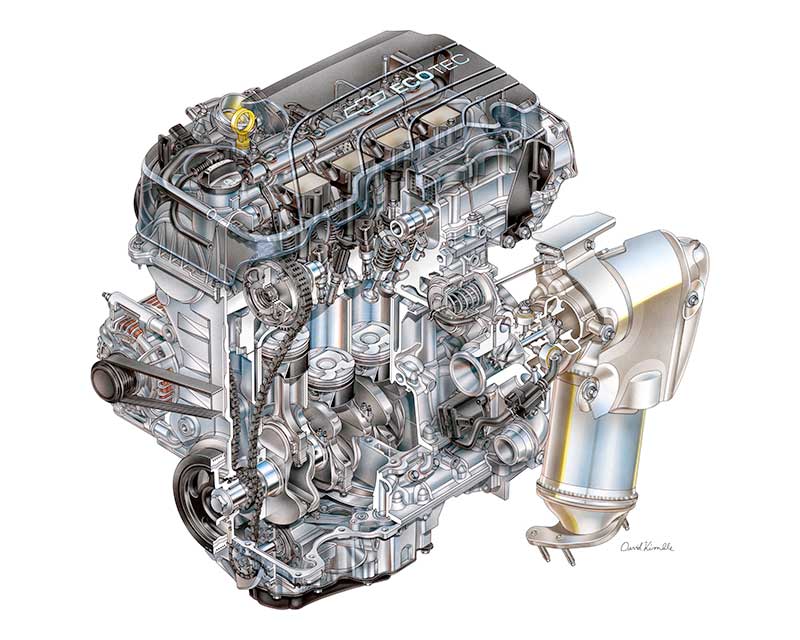

Illustration: David Kimble. © General Motors 2016

Average rated fuel efficiency of light-duty on-road vehicles in Canada (litres/100 km)

The balance between vehicle weight, energy use and occupant safety is very challenging, and meeting future safety standards together with higher fuel economy requires very significant advances in technology. For instance, the easiest way to make a vehicle safer is to add weight, which obviously works against fuel efficiency; thus the focus on new technology across all vehicle companies and all elements of the vehicle. And these advances in technology have to come to the industry quickly, be totally reliable and enable manufacturers to maintain fiscal discipline and accountability. Quite a challenge.

It is also important to understand that all technology forecasts are conservative by nature in that they assess only current technology and struggle to account for emerging technologies and indeed innovation in general. Proponents of BEVs and hybrids claim that fuel efficiency improvements in ICE vehicles are now largely behind the industry and the only way to meet mandated standards is by electrifying current vehicles. Yet vehicle engineers will tell you that not even the low hanging fruit has been harvested with ICE vehicles. Technologies like gas direct injection (GDI), high compression ratios, supercharged and turbocharged engines, and continuously variable transmissions (CVTs) have defied all projections by achieving expected improvements in only a few years instead of the decades that were forecast. GM’s new Ecotec engine uses variable valve timing (VVT), turbochargers, multiple sensors and powerful electronic control units to manage engine functions, all of which increase power and reduce vibration and fuel consumption.

The power of weight reduction

Perhaps the single biggest advancement has been in the field of light-weighting. Vehicles were projected to decline in weight by less than 10 percent by 2025; however, using advanced technology this goal has already been met. For example, the most popular vehicle sold in Canada is the Ford F-150 pick-up truck. By increasing the use of aluminum, Ford doubled the truck’s light-weighting projection more than a decade earlier than forecast. Light-weighting is also of critical importance to the acceptance of BEVs since the range of these vehicles would increase by close to 20 percent if mass can be reduced by half. With ICE vehicles there is a six to eight percent increase in fuel economy for every 10 percent reduction in weight.

But not only weight reduction has exceeded expectations. Exhaust gas recirculation was considered leading edge technology only a few years ago but even this advance is expected to be obsolete as vehicle companies move toward advanced Miller-cycle turbocharged engines that alter the length of piston connecting rods in conjunction with advanced hydraulics and currently yield upwards of a six percent improvement in fuel efficiency. Coupling turbochargers with small electric motors allows OEMs to use smaller engines for a fuel efficiency improvement that has exceeded 20 percent in some cases. There are dozens if not hundreds of technologies that are providing important improvements. Each may be very small but collectively they are poised to significantly alter the fuel efficiency of all ICE vehicles.

Impressive fuel-consumption reductions

Researchers in the United States report that by using current advanced technologies including those mentioned in this article, it should be possible to achieve fuel efficiency of under 3.5 litres per 100 kilometres by 2050. And most importantly this level of fuel efficiency is achievable without reverting to BEVs or hybrid vehicles. The average fuel efficiency of a new vehicle bought in Canada this year is 10.4 litres per 100 kilometres so upwards of a two-thirds reduction in fuel consumption is possible.

In summary, expect:

- reduced weight through advanced materials and design

- more diversity and complexity of conventional powertrains including gasoline, direct injection gasoline, diesels and alternate fuels like LNG, propane and ethanol

- turbocharging, supercharging, CVTs, and transmissions of up to 9 speeds, and

- continued electrification of vehicles

The vehicles that Canadians will purchase over the next 25 to 35 years will be radically different than those purchased over the last 25 to 35 years and will have fundamental implications for all who touch the automotive sector: fuel suppliers, repair shops, body shops and car dealers. Hang on folks—it is going to be quite a ride.

© 2016 Ford Motor Company of Canada