Survive and Thrive

Dennis DesRosiers is an analyst and is President of DesRosiers Automotive Consultants

For more than 30 years, the three most important words in the automotive sector have been quality, quality and quality. It means that consumers held onto their vehicles longer, and fuel efficiency continued to improve.

The Japanese sold their first vehicles in Canada in 1965 and began to secure a major market share during the 1970s and 1980s. While superior fuel economy in a time of higher fuel prices no doubt contributed to the popularity of these vehicles, numerous studies identified overall product quality as the key to Japanese manufacturers’ success.

With the loss of market share, other manufacturers were determined to improve the quality of their vehicles. Billions of dollars were invested in this effort. And when the power of the automotive sector is focused on a specific goal, the industry succeeds. Every metric available indicates that vehicles are much better built today than a decade ago, let alone two and three decades ago.

Higher quality vehicles last longer

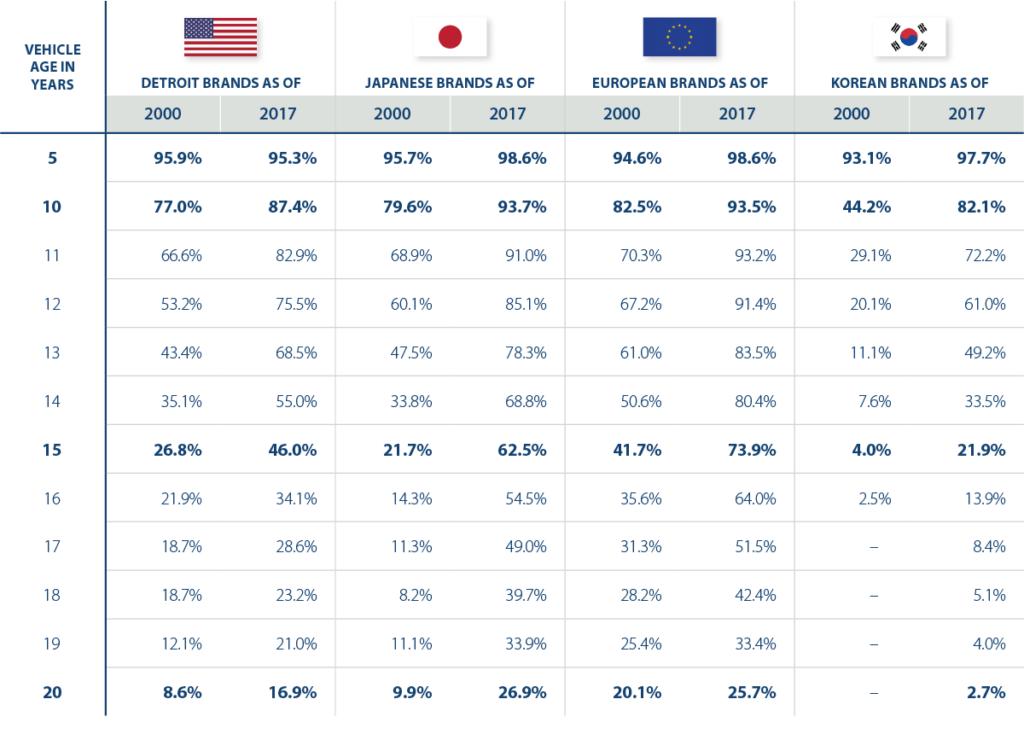

The related metric I like to follow is vehicle survival rates. We measure these rates with a great deal of precision. We know the exact number of every make and model sold in Canada each year going back more than 30 years. We also have the exact number of vehicles by make and model that are still on the road in Canada as of July 2017. Divide those two metrics and you get survival rates.

Table 1 shows the massive improvement since the turn of the century. The survival rate of every brand has increased over virtually every time period examined. The 15 year-old vehicles tell the story particularly well. In the year 2000, 26.8 percent of Detroit branded vehicles survived 15 years of ownership compared to 21.7 percent of Japanese brands, 41.7 percent of European brands and only 4.0 percent of Korean brands. Skip forward to the year 2017 and you see substantial increases across all manufacturers: survival rates for Detroit brands increased to 46.0 percent, Japanese brands to 62.5 percent, European brands to 73.9 percent and Korean brands to 21.9 percent.

Table 1: Survival rates by major brand groupings as of 2000 versus as of 2017

What do survival rates have to do with fuel demand?

First, while these older vehicles were generally well engineered, their average fuel efficiency was poor compared to current models; the more of these vehicles that remain on the road today, the higher the demand for fuel. Second, a vehicle’s fuel efficiency deteriorates from its original rating over time. It is hard to say how much but 15 percent is a reasonable assumption after about a decade of use. This decreasing fuel efficiency has likely further increased fuel demand. Third, higher survival rates mean that the availability of older, lower-priced vehicles on the market increased dramatically between 2000 and 2017. This buyers’ market for affordable used vehicles is viewed as the primary reason vehicle ownership among the driving age population increased from less than 70 percent in the year 2000 to more than 85 percent in the year 2017. As a result, there are more than nine million more vehicles on the road in Canada today compared to 2000.

While it may seem counterintuitive to penalize overall vehicle quality by removing older vehicles from the road, promoting the choice of new and highly fuel efficient vehicles may be the best way to reduce fuel demand, as well as related emissions.