A ripple Effect

Understanding Canada’s transportation fuels infrastructure

Jason Parent, Vice President, Consulting, at Kent Group Ltd.

HOW FUEL FROM A REFINERY REACHES A LOCAL GAS STATION IS GENERALLY NOT WELL UNDERSTOOD.

We similarly lack awareness about other supply chains, such as those that bring food into our grocery stores—yet we expect to see oranges in the fruit aisle in January.

In much the same way, Canadians have come to expect the seamless availability of gasoline at the pump, and expect this fuel to perform to specific standards, like being able to start our engines on a hot summer day or at -30C in January.

As with any supply and distribution network, a change or interruption to product manufacturing or logistical processes can have wider implications. This is certainly true in the downstream transportation fuels sector; its infrastructure and supply chain affect the daily movement of people, product, and the economy at large—that’s a wide implication.

Policy activity designed to address both global and domestic climate objectives punctuate the need for better understanding of the infrastructure that powers Canadian drivers. With road transportation emissions comprising roughly 19% of Canada’s GHG emissions, stakeholders are seeking to pull levers in areas like carbon pricing, renewable fuels development and clean fuel standards—all of which have the potential to impact the transportation fuels sector, and consumers.

The importance of understanding the current infrastructure

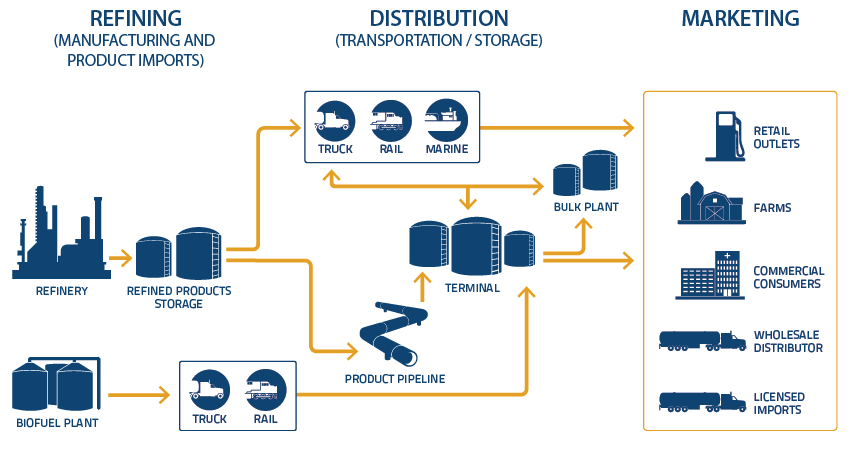

The refining and distribution of transportation fuels is multifaceted and complex, delivering around 85 billion litres of fuels to Canadians each year. Writing robust climate policy is also complicated, emphasizing the importance for stakeholders and policy-makers to know the system, the processes, and the products they seek to change as they work toward effective and affordable emissions reductions. It’s why Kent Group recently finished a multi-stakeholder report called Canada’s Downstream Logistical Infrastructure.

The report is an inventory of Canada’s refineries, fuel terminals, bulk plant facilities, cardlock sites, and distribution networks by pipeline, rail, sea, and road. Additionally, the report covers biofuel production facilities, biofuel blending, trans-shipment facilities, and airport fuel storage for a more complete capture of the broader network.

Downstream sector

Refining, distribution, marketing

Infrastructure is only part of the story

Aside from infrastructure, the products and their markets must also be considered. For example, there is a seasonality to the formulation and demand for transportation fuels in Canada—summer fuels are different than winter fuels. Refineries and the supply chain must accommodate the shifting regional product specifications and market needs throughout the year, all while meeting a range of regulatory requirements and minimizing costs.

Additionally, transportation fuels often trade openly across both interprovincial and international borders, and these markets can be altered by regulations that impact either fungibility of the product or price.

There are currently six biofuel blending mandates across Canada—five provincial and one federal, as well as complex and often incompatible mandates in U.S. markets. This patchwork of regulations can complicate both trade and compliance, and when added to an already non-linear supply and distribution network, presents a regulatory challenge on one hand, and a logistical challenge on the other.

The logistics of biofuel blending, for example

The logistics of biofuels blending in Canada involves a range of stakeholders, a number of transportation modes, and increasingly complex and costly infrastructure; it’s a good example of how regulations impact infrastructure and logistics.

Almost all blending takes place at the primary supply terminal (or rack point) requiring the coordination of inbound logistics from both biofuel producers/importers and conventional fuel producers/importers, then delivery to retail or commercial sites.

Typically, biofuels are blended into gasoline and diesel at the terminal for truck transportation. Ethanol is most often a “proportional blend” to a formulation of 10 percent ethanol and 90 percent octane-adjusted gasoline blend stock, producing an on-specification “E10” blended gasoline. Similarly, biodiesel is typically blended at a rate of 2 to 5 percent biodiesel. Regions that are not sufficiently or reliably supplied with biofuels can face significant logistical challenges if required to blend.

As with any supply and distribution network, a change or interruption to product manufacturing or logistical processes can have wider implications.

Biofuels are often transported to terminals by rail or by ship. Many terminals lack sufficient rail or ship offloading facilities, requiring investments to build such amenities or the use of trans-loading to allow inter-modal transfer of product (from rail to truck, for example). Conversely, the vast majority of petroleum products are delivered to terminals via pipeline, a much more efficient and cost-effective and less emissions intensive form of transportation.

Any new renewable fuels regulations or clean fuel regulations can have implications throughout the fuel supply chain. For instance, an increase to the regulated blend percentage for ethanol would present challenges for ethanol producers (likely requiring more imports), refiners (adjusting product formulation to be able to blend on specification), shippers and blenders (with both infrastructure and logistics), and potentially retailers as higher ethanol blends can require upgrades to existing pump and tank technology.

As stakeholders and decision-makers move forward with climate action involving transportation fuels, it’s important to understand how this energy is refined, transported, blended, and delivered to Canadians every day. After all, it is what ensures that oranges make it to your local grocery store.