Consumers apply a range of criteria when they shop for transportation fuel. They look for different grades of fuel, and may have a preference for one brand over another. Quality is never a question. Convenience is one criteria — choosing a filling station that’s easy to get to. Range of services is important for consumers who want access to a car wash, convenience store, etc. But the main focus is price, which explains why Canadian drivers have so many questions about how much they pay for transportation fuels.

Why does the price change so much?

Crude oil and wholesale gasoline and diesel are commodities like coffee or wheat. The value that traders place on a commodity changes based on market conditions and underlying supply and demand dynamics. Think about house prices. Although homes are not a commodity, their prices fluctuate in any particular market according to supply and demand.

Why isn’t the price of gasoline in lockstep with the price of crude oil?

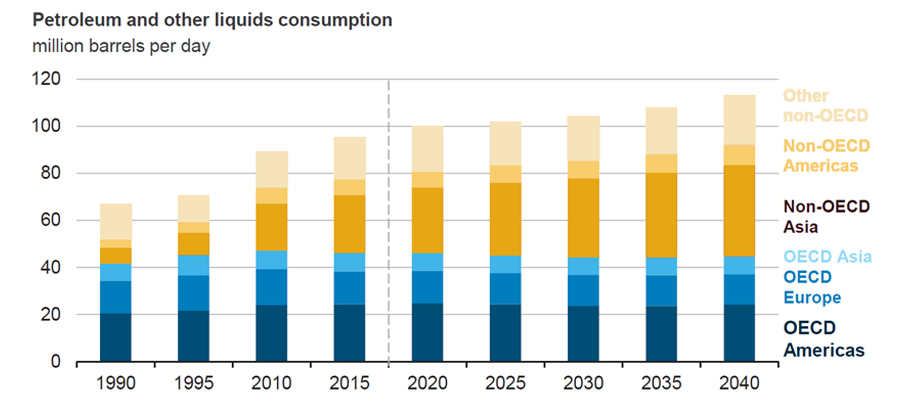

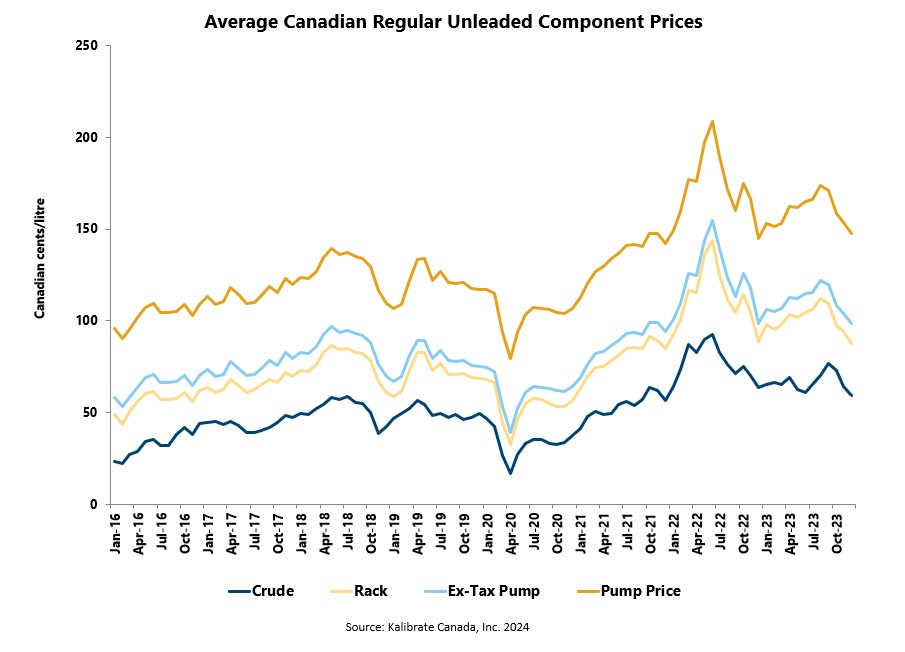

Crude oil and the transportation fuels derived from them — gasoline and diesel — are distinct commodities. Their prices respond to supply and demand conditions that are often quite different. Their market values change independently, at times moving in opposite directions. Recently, the global supply of crude oil has exceeded global demand. The demand has recently grown for gasoline in North America. This shift in the continental supply-demand balance exerts upward pressure on the price of gasoline. So while gasoline prices are down, they may not have declined to the same extent — or at the same time — as crude prices.

Why is petroleum fuel less expensive in the U.S.?

Wholesale fuel prices include all refinery production costs including the cost of crude. The wholesale price is what the retailer pays when purchasing fuel at the wholesaler’s terminal or ‘rack’. Canada is part of an integrated North American wholesale fuels market. As a result, Canadian and U.S. wholesale fuel prices generally go up and down in tandem; however, wholesale fuel commodities are traded in U.S. dollars, so the price volatility in Canada is partly due to exchange rates. When the Canadian dollar falls in value relative to the U.S. dollar, the wholesale fuel price in Canadian dollars rises.

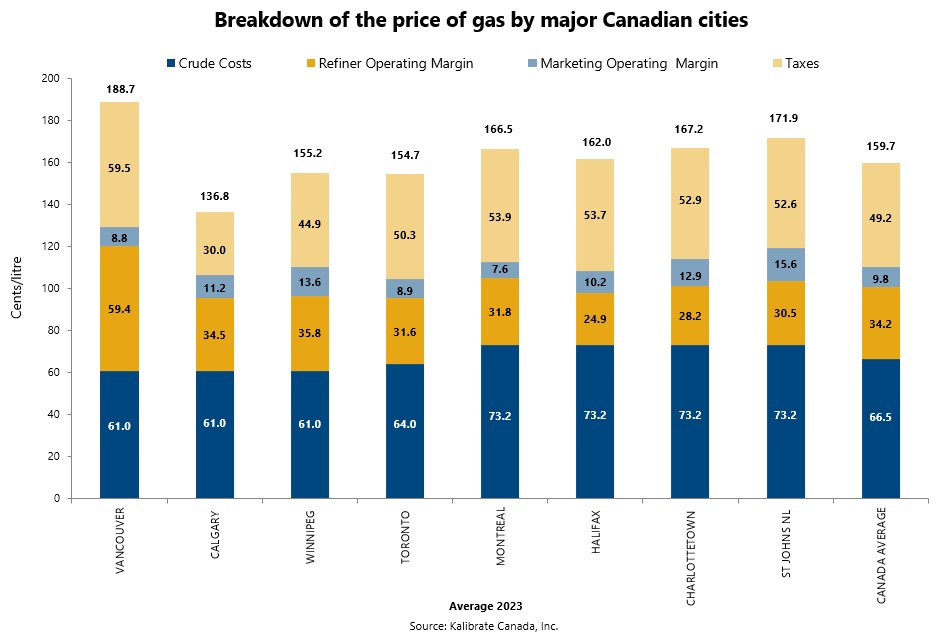

The most significant factor in price differences between Canada and the U.S. is taxes. In 2023, Canadian taxes accounted for an average of 49 cents on each litre of petroleum fuel. At the same time in the U.S., the average tax component was approximately 21 cents per litre.

Why do different retailers in my community all seem to have the same price, why is gasoline more expensive in my community than elsewhere?

Retail prices include wholesale fuel costs, transportation costs; carbon tax, federal, provincial and in some cases municipal taxes; and a margin to cover retail outlet operating costs and provide operators a profit. The pump price at any retail outlet is influenced by local supply and demand dynamics. So while retail pump prices generally rise or fall in response to changes in wholesale prices, individual retail outlets are continuously balancing the need to be competitive with the need to maintain a viable retail margin. Market size and remoteness, number of competitors, sales volumes, seasonal demand changes, and the range of services offered are just some of the factors at play. In a highly competitive local market, prices can be quite volatile as retail operators strive to remain competitive with other operators in close proximity. It’s a delicate balance. Pricing too low means losing money, too high means losing sales.

Don’t big oil companies set the price at the pump?

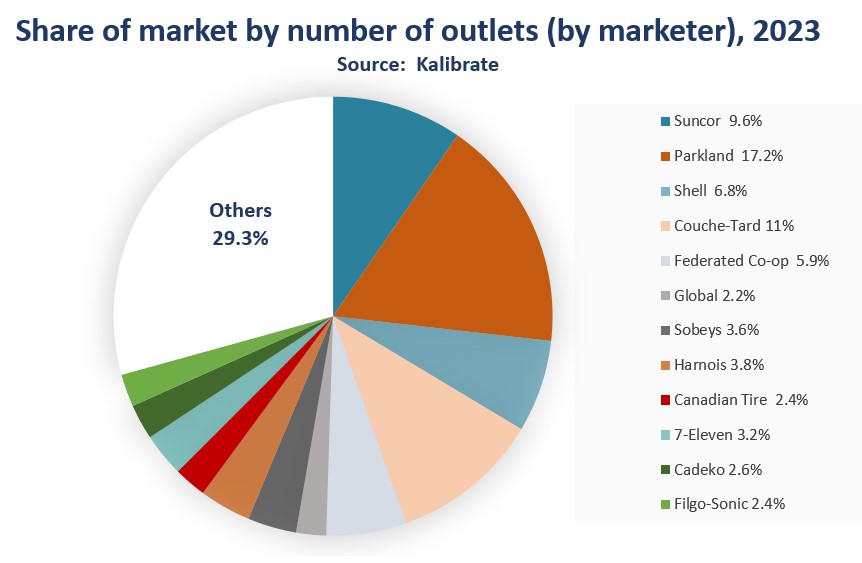

Canada’s retail marketplace is actually quite diverse. A recent census by Kalibrate (2023 National Retail Petroleum Site Census) identified 66 different companies involved in the marketing of retail petroleum fuels with 97 distinct brands of gasoline. In numbers that are at odds with the traditional public image of the industry, integrated refiner-marketers control the price at only 22 percent of retail gas stations in Canada. The prices at 78 percent of stations, including many that operate under the brand of a major oil company, are controlled by proprietors or companies not involved in the refining of petroleum products.