VP Opinion

Lisa Stilborn is the Canadian Fuels Association’s Vice-President, Ontario.

Making Sense of Carbon Pricing

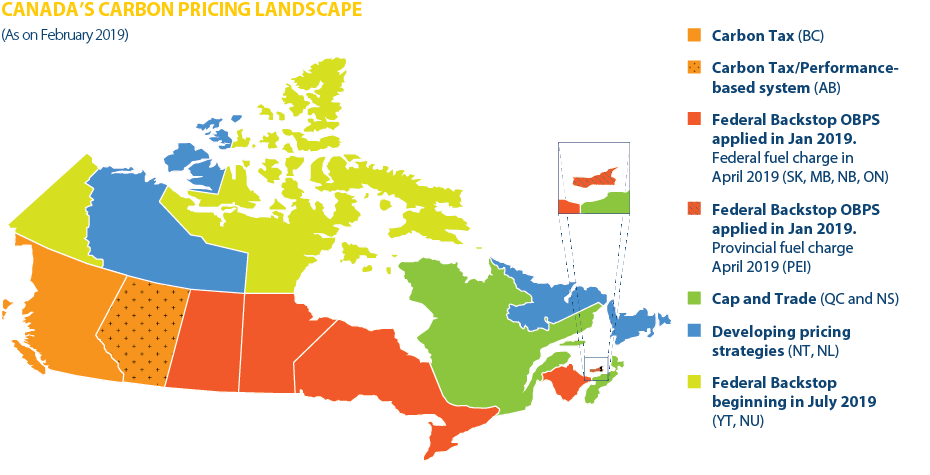

Consumers are understandably confused about how carbon pricing works and how it can impact the cost of transportation and household goods—especially in light of the range of policy approaches across Canada. British Columbia imposed a carbon tax. Alberta chose a carbon levy. Quebec and, until recently, Ontario implemented cap and trade programs. In addition, the federal government began imposing a carbon price of $10/tonne in 2018 in provinces and territories that do not have a carbon pricing system in place (the federal carbon pricing backstop). That price will continue to increase by $10/tonne per year until 2022.

Governments appear reluctant to tell consumers what carbon policies could do to household expenses, including fuel costs. This communication shortfall has perpetuated the idea that climate change is industry’s problem. The elephant in the room is transportation, including personal transportation. Across Canada, transportation-related greenhouse gas emissions continue to go up while industrial emissions decline.

Designing policies and communicating their impacts is a delicate balancing act. The rationale for carbon pricing is to send a price signal in the marketplace, thereby driving behavioural change throughout society and among consumers. Yet if consumers do not modify their behaviour, policies may just look like taxes.

Consider Ontario. The former Liberal government opted for cap and trade—a flexible carbon pricing option, but one that may appear less transparent to consumers. Indeed, public opinion research says that cap and trade is wrongly perceived as a cost to business rather than a society-wide cost on carbon. Ontario Premier Doug Ford quickly cancelled this program, calling it a tax grab that yielded no climate change benefits.

British Columbia was an early adopter of carbon pricing. The province’s policy makers get high marks for transparency. The government shared with citizens that the tax would increase household expenses and introduced personal tax relief to recognize that costs like personal transportation are a necessity.

Alberta took a similar approach with its carbon levy, building a rebate program for families below the provincial income threshold.

We don’t know how the federal government will manage carbon price impacts on consumers, but it can draw on these provincial experiences. Policy makers are also well advised to heed public opinion research that indicates the majority of Canadians may have accepted the personal sacrifices associated with climate change, but expect to see real environmental progress in return.